If you are making contribution to any charitable organization or any welfare group then it is essential to have contribution receipts because these will help you to claim tax deductions. Internal Revenue Service (IRS) requires these receipts to support your claim. There are some groups that are recognized by IRS for the tax deductions such as non-profit charities, churches and governmental units including Native American Tribes. After making contribution, do not forget to ask for the receipt and make sure to have complete details on the receipt. It is the responsibility of charity organization to provide receipt to contributor at the time of contribution so that he/she can claim for tax deductions to reduce his/her expenses. Well designed contribution receipts with complete details can benefit you in the true sense so make sure to have them after complete detailing.

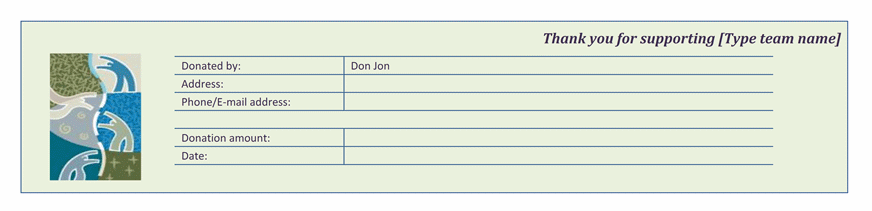

Here is preview of this Contribution Receipt Template created using MS Word,

Contents for Contribution Receipts

Considering the benefits and importance of contribution receipts, we are going to share some important contents that should be written on the receipts for your future benefits and tax deductions:

Details of Contributor and Organization

Contribution receipt should contain complete information of contributor and the name of organization. It is necessary for the identification and assessment of IRS because this department requires it to identify the contributor. IRS has some specific limitations and standards about the legitimate charity and welfare groups. You have to check in advance either your selected group is tax-exempt on IRS website.

Date of Contribution

Date and contribution time is really important so it should be included in the receipt to ensure the application of tax exemption in the appropriate year.

Amount of Money or Goods

If you are making monetary contribution then you have to write exact dollar amount on the receipt. In case of contribution of goods such as car or another vehicle, the charity will offer an estimated value or a good faith estimate according to the item. If you are contributing high-ticket item then it should be filled in the noncash charitable contribution receipts.

Contribution or Charity-provided Services

If the charity organization receives a service then the value of service or gifts should be written on the receipts as well. For instance, if the services are provided by contributor to the religious organization then the receipt should contain a note showing “intangible religious benefits” from the contributor. IRS is not placing the value on the religious benefits because these are non-monetary in nature but still these should be recorded as services. If the services are rendered to non-religious group then the service can be noted down on the contribution receipt with the monetary amount.

Things to Consider before Contribution

If you are interested to take tax deduction benefits also from your contributions then it is essential to search about the qualified organizations by IRS. The list is available at the official website of IRS under Publication 78. You will only get deduction in the same year in which the contribution is made. You have to generate all important documents in advance to show them to IRS as legitimate proof of your contribution and eligibility for tax deductions.

Here is download link for this Contribution Receipt Template,